december 2002

Jairo Lugo is Lecturer at The School of Media, Critical

& Creative Arts Liverpool, John Moores University (UK)

Tony Sampson is Senior Lecturer School of Innovation &

Cultural Studies at The University of East London (UK)

Merlyn Lossada is Lecturer at The School of Social

Communication, Universidad del Zulia (Venezuela)

Latin America's New Cultural Industries still Play Old Games

From the Banana Republic to Donkey Kong

by Jairo Lugo, Tony Sampson and Merlyn Lossada

Introduction

This article explores the video games industry as part of what has become known as the "cultural industries" (Hesmondhalgh 2002), using Latin America as a case study. We suggest that the video game industry possesses a political economy that responds to the same principles and patterns a conventional business does. In our view, this industry has specific technological values defined by "convergence and digitalisation" (Baldwin et al. 1996) and shared by other so-called new media. We suggest that they are indeed key factors in explaining the development of this sector, but,as we argue, by no means represent an alteration of the relationships between the economic agents of production, distribution and consumption. Instead, like other cultural industries, the video games industry tends to reproduce the political economy of the system of relations in both the structure (economical level) and superstructure (ideological level), at least in the case of Latin America.

There has been much optimism in this region in regards to the potential of new economies. The announcement made by Microsoft at the beginning of 2001 that the Xbox would be manufactured in Mexico[1] was perhaps one of the most important indicators that in the following years the US game industry would try to create an alternative pole of development away from the Far East The "return of Captain America" (Price 2001), a phrase analysts coined to describe the reemergence of the US in the global video games market[2] , was optimistically interpreted as an important opportunity for Latin America to develop its own game industry or, at least, as a chance to develop indigenous value-added products and services in this thriving sector. However, evidence suggests otherwize, with companies such as Microsoft and Nintendo – in joint ventures with local toys and games manufactures – developing a manufacturing-marketing model for video games in Latin America based on local assembly-lines, located in "special" economic areas where the main components were shipped from abroad with very little added value from the local industrial community. This scheme has been widely described in Latin America as the model of Maquilas (Stoddard 1987) and is seen as part of a strategy to improve market competitiveness. The model of the Maquila has been operating since the 1970s and takes advantage of the potential of the North American Free Trade Agreement (NAFTA)[3] , which not only facilitates access to cheap labour, but also provides exporting facilities based on a substantial reduction of tariffs to the US market.

In our view, the production model of consoles, accessories and software for video games follows the same pattern of traditional industries such as automobiles and white goods. Furthermore, the technological "values" that characterize the video games industry have had little impact on the relationship that exists between the various economic agents. Evidence suggests that companies such as Microsoft and Nintendo are investing in Mexico, Costa Rica and Brazil in order to develop low-cost production centres capable of exporting to the US market using the opportunities that NAFTA and other inter-regional agreements provide. This simply repeats the way in which traditional industries moved their production operations to low cost-centres in the Far East in the 60s and 70s. In addition, these industrial realignments are not simply based on current legislation and international agreements, but also on the widespread perception that the subcontinent will, in the near future, offer an investment space that will allow certain industries to avoid legal constraints and regulation and take full advantage of the exportation facilities to the US market. Therefore, this research not only incorporates a prospective analysis using current quantitative data available, but also takes into account the perceptions of entrepreneurs and businessmen from the video games industry.

This article is especially critical of the assumption that the video games industry is exempt from the traditional frame of cultural industries since it possesses a different set of technological values that makes it unique. Indeed, the evidence suggests instead that the transfer of technological values, defined by digitalization and convergence, is offering little opportunity to create an indigenous games industry that could provide added value (in terms of software). Consequently, we suggest that even though the technological values that characterize the video games industry are relatively different from traditional cultural industries (analogue media such as radio, television, film, etc), the nature of the economic relations between the agents of production is the same.

El Paso to a Big Place

More than three decades ago Celso Furtado (1970) wrote that economic analysis is merely a first approach to the study of complex historical processes under way in Latin America. In fact, his postulate that what is happening in the region "is largely conditioned by exogenous variables" is still valid. Traditionally, Latin America has been defined as the "backyard" of the US and the trivial assumption exists that it is a group of "Banana Republics incapable of producing anything but raw materials, very good rum and fat dictators." More elaborate views seem to acknowledge the region's media and telecommunications markets as a Kafkian chess game, in which the invisible hand of the market, alongside the tangible arm of politics and the suspicious intentions of international corporations, moves the pieces in several directions (Cole 1996).

In terms of the video games industry and new media, Latin America is a contradictory and changing market. In the past two decades most countries in the region have experienced deep and dramatic changes in their political structure (Cordeiro 1995) and have gone from highly politicized societies with centralized economies that included a strong role of the state and political systems mostly characterized by military dictatorships into formal representative liberal democracies that are increasingly deregulating their economies and attempting to gain entry into the global market. All of these changes correspond to a process of "political demobilisation" (Tironi and Sunkel 2000).

One of the most important changes happened in the communications and media sector in the mid 1990s when Latin America privatized its telecommunications industry and saw the return of important flows of investment into the region for that specific area (Inter-American Development Bank Annual Report 2000). Significant amounts of capital were allocated to telecommunications, media and computing sectors, especially in Brazil, Mexico, Costa Rica, Venezuela and Argentina. For the telecommunication and computer sectors, Latin America is today one of the fastest growing regions in the world, even though is still a marginal market in comparison to the US, Europe and Asia. Steve Ballmer, vice-president of Microsoft, perhaps the most important new player in the video games industry, stated that Latin America has been the fastest growing major region for Microsoft over the last three to four years and expects that it will continue an "incredible" growth[4] (Reuters 2001). The company said it has seen an average annual growth of 30 percent in the last three years in the region, while its global growth has been 5 to 10 percent a year.

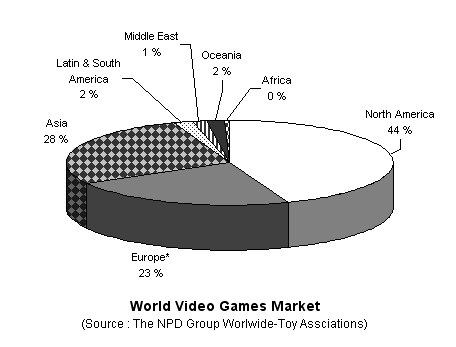

It appears that US companies are not necessarily interested in developing manufacturing lines and infrastructures to satisfy the local market. As such, the investment in local information and communications technology (ICT)-related industries seems mainly to be made in order to improve export competitiveness[5] , since US high-tech companies are interested in both the current potential of the local market[6] and the future use of Latin America as a platform to export to the US and Canada. This view is supported by the size of the market itself, which does not justify the amount of investment in telecommunications and digital technologies in the past five years. For example, only 1.5 percent of Latin America's population is connected to the Internet on a daily basis while the rate in the United States is estimated at 37 percent. In terms of the video games market Latin America represents a marginal segment of world sales: only 2 percent of the world consumption of software and hardware (Figure 1).

Figure 1

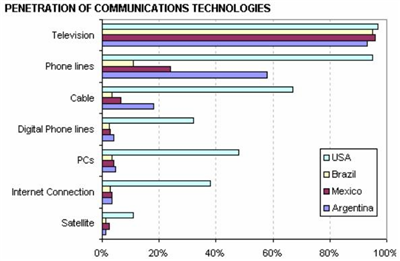

Another element of the internal market that casts doubt over US investment relates to technological penetration. Latin America comprised just 3.2 percent of the 165 million worldwide users of the Internet in 1999 (Gómez 2000). In other words, the region is not exactly ahead in the use of ICT (Figure 2).

Figure 2

(Source: Infoamerica)

Furthermore, a report from the market and technology research company, Dataquest (Gartner Group 2001) shows that the digital divide in Latin America is widening and there is very little chance of an exponential growth of ICT in the region in the near future. Based on a study of access to basic telephone services and to broadband Internet access services, the report points out that 80 percent of US consumers have telephone connections compared to 24.5 percent of Chileans. This is an interesting figure if we consider the fact that Chile has the highest number of phone connections per capita in the region. Argentina follows with 23.1 percent of people having phone connections; Colombia is next with 22.4 percent and Brazil with 20 percent in a region with an average figure of 17.3 percent. The Dataquest research also points out that "Latin America trails far behind the US in terms of broadband use. Over 6 million Americans have broadband Internet access, while only 53,000 Brazilians, 38,000 Argentineans, 22,000 Chileans and 20,000 Mexicans had access in 2000."

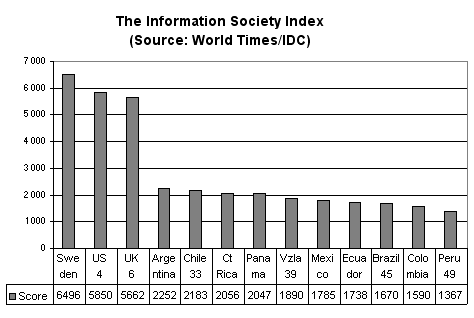

Another important reference that supports this view is the Information Society Index (ISI)[7] , which highlights an abysmal gap between the ISI of Latin America and most developed nations (Figure 3).

Figure 3

(Source World Times/IDC Information)

There is not a single Latin American country that can be classified as a "skater" (ISI score above 3,500), a nation in a strong enough position to take full advantage of the Information Revolution because of advanced information, computer, Internet and social infrastructures. Moreover, Brazil, Mexico[8] , Colombia, Venezuela, Ecuador and Peru do not even classify as "striders" (ISI score above 2,000),nations moving purposefully into the information age, with much of the necessary infrastructure in place. In fact, most Latin American markets can be classified as "sprinters" (ISI score above 1,000), countries moving forward in spurts before needing to catch their breath and shift priorities because of economic, social and political pressures.

Nevertheless, the contradictions of the apparent under-developed market emerge when we compare specific production areas from specific countries. The potential for the video games industry in Latin America not only lies with the market itself, but also with the unrealistic perception of the region as a possible platform for exporting and improving global sales. For example, in the "Toys and Games" world survey, Euromonitor (1999) points out that accessories for the video games market in Japan were "worth just US$ 13.3 millions in 1998, only US$ 4 million higher than sales in Brazil." Further, the Japanese market registered a slight decline between 1994 and 1998[9] while Brazil presented a 3-year growth rate. The report also highlights the fact that the US represents 80 percent of the global accessories purchased and that many of the accessories produced and sold in Brazil ended up in the US market.

Consequently, there are factors that indicate that the development of a video games industry in Latin America could respond more to its potential as a low-cost producer and exporter rather than to its potential as a consumer-market.

Focusing on the Game

At this point it seems clear that market perception plays a key role in motivating investment and the development of the industry as a whole. A focus group composed of entrepreneurs, managers and businessmen from the video game industry based in Caracas (Venezuela), but with experience in other Latin American countries,[10] discussed a set of structured questions related to the nature and future development of the Latin American video games industry. The group dynamic also included a strength, opportunities and weakness analysis. The dynamic brought interesting concepts into the discussion, and, even though it does not have general validity, it did provide an "insiders approach" to the industry's view on itself.

All the participants agreed that there a video games industry did not exist in the pure sense, but, instead, existed as part of a significant toys, games and computer industry "defined by international corporate structures and trends." The participants recognized the potential of the market, not by itself, but as part of a wider context (which matched our statistical findings). Six of the members of the focus group remarked several times on the potential conditions created by the NAFTA and other economic reforms that were taking place in Latin America. One of the participants stated that:

You have a potential market of over 500 million inhabitants and a deregulated platform to export to the US in the context of unified customs [area], homogeneous tax regimes and competitive labour force. All this is happening in the back yard of the biggest video game market in the world.

The participants also agreed on the importance of the Latin American market, "where sales are improving in the last 24 months" and that sales of video games "seemed not to be affected in the same levels as other products and services," but express concerns that by itself could justify the amount of intensive investment that the development of an indigenous industry would demand.

One of the participants from the marketing department of a regional office of a games firm pointed out the specificity of the market in the region compared to other industries:

The video games market in Latin America seems to maintain atypical trends regardless of the rest of the market. In other words, we have observed that even though the consumption index drops for computers, services and other types of ICTs, this is not necessarily the case of video games. You can maintain steady sales or register a big drop and in neither case observe a relation with the rest of the market.

The group agreed on several common patterns of the video game industry in Latin America. The first pattern is that "Latin America is not a homogeneous region and therefore cannot be evaluated as a single market." For example, one participant who worked previously in Sao Paulo argued "that Brazil is not per se only the biggest market but also a region within a region." The participants pointed out that even though the region has important social disparities of income from one social stratum to the other, "the [nature of the] patterns of consumption are very similar to the developed world."[11]

A second pattern perceived by the participants was that Latin America has knowledge, technology and a manufacturing capability to develop hardware. Or include source? However, this is not necessarily the case in regards to software. Indeed, as one participant from the software sector said, "Development of software and applications for computer games needs important investment in development and research." This same participant pointed out that:

At the beginning in the late 80s, video games were not sophisticated. What was important was that you had a creative project and some programming skills. A very basic-black and white Ping-Pong game was a success. This is not the case anymore. Kids and adults want quality, reality and dimensionality. And that takes money and resources.

There was consensus in the group about this. Furthermore, the group agreed that local entrepreneurs in the region would be less willing to venture into software than in hardware. As one businessman put it:

Although it seems that software provides opportunities to develop a new industry with low investment and risk, the reality is very different. When you develop a game, you need high tech equipment, with lots of memory for the graphic processing. Your whole project will depend on people sitting there, people with skills that demand first world salaries and that in any moment will jump to a competitor or even outside the country letting you hang in the air. At the end of the day, you are there alone, on your own, risking an important amount of capital.

Another participant added:

This is not the case with hardware. Developing software for video games could be all right as a personal enterprise, but it is not a decision that many toys manufacturers in Latin America can afford. Hardware seems to be a logical and rational path for the local companies. If you intend to manufacture hardware you will be probably doing it under license, with distribution channels already guaranteed and better financial conditions for the investment.[12]

However, the members of the group agreed that the development of software for video games is not impossible and that it could happen, pointing out interesting examples in the educational area[13] . But all participants made it clear that in the current conditions it would be very hard for Latin America to develop a competitive software industry.

Another pattern observed by most participants is that despite legal insecurity, political instability and inadequate facilities--the most significant weakness of the region as an alternative pole of development for the video games industry - an exporting culture is still being developed on the continent. All of the participants recognized that a more stable political and institutional framework needed to be built and mentioned that the process of privatization and the deregulation of telecommunications and services were rapidly improving the situation. This was not the case concerning legal security for investment since courts and legal systems are still perceived as "incompetent, highly politicized and susceptible to corruption."

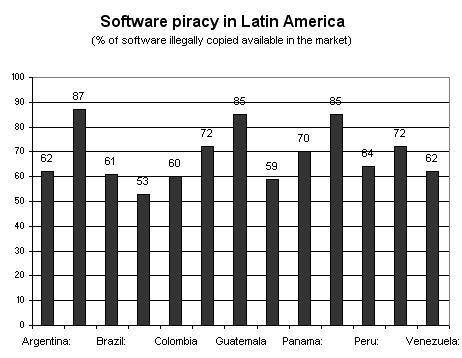

The group perceived "piracy" - the illegal reproduction of products--as the major threat to the future of the video games industry in Latin America. This perception matches available statistical data. The Venezuelan Council for the Promotion of Private Investment (Conapri 1999) estimates that the software industry in Latin America is threatened by an average piracy rate of 68 percent (Figure 4).

Figure 4

(Source Conapri)

In conclusion, the participants saw access to the US market as the most important element to address if the region wanted to seriously develop a video games industry for both hardware and software. This was one of the most recurrent remarks during the session. Participants were aware of and concerned about the impact the continental free trade agreement had on the industry's potential. All of the participants perceived that this would not only mean wider access to the US video games market[14] , but would also translate into a more politically stable and legally secure environment for investment.

Big and Small Apes in the Banana Republic

As one of the participants in the focus group said, "we cannot talk about a proper Latin American video games industry, but about a basic industry that locates itself between local representation of the global video games industry and the 'appendix' of the national toys and games industries." This definition appears to be accurate if we analyse the market trends and the role of the players. Defining the video games market as a Maquila of the global industry seems then to be right. The Maquila is a type of industry very common in the north of Mexico and other Central American countries that are operated by US, European and Asian corporations to assemble parts of industrial products (mostly white goods and electric appliances) and then export them to the US, taking advantage of inter-regional agreements. The Maquila, also called Maquiladoras, are industries managed by international corporations in economically deprived areas that mainly import spare of certain products, assemble them using cheap labour and export them tax free to the US. Significantly, the Maquilas benefit from special government treatment--presumably justified by the fact that they are located in poor areas--and in most cases are exempt from taxation and do not have to comply with national laws with regard to employment or the minimum wage. There are a great number of Maquilas in Mexico, Central America, and are increasing in number in South America. Maquiladoras became popular in the advent of NAFTA. It is also interesting to note that several of the global corporations that have Maquilas along the US-Mexico border are directly, and indirectly, involved in the video games industry (Table 1).

|

Maquilas along the US-Mexico Border |

|

|

3 Day Blinds 20th Century Plastics Acer Peripherals Bali Company, Inc. Bayer Corp./Medsep BMW Canon Business Machines Casio Manufacturing Chrysler Daewoo Eastman Kodak/Verbatim Eberhard-Faber Eli Lilly Corporation Ericsson Fisher Price Ford Foster Grant Corporation General Electric Company JVC GM Hasbro Hewlett Packard Hitachi Home Electronics |

Honda Honeywell, Inc. Hughes Aircraft Hyundai Precision America IBM Matsushita Mattel Maxell Corporation Mercedes Benz Mitsubishi Electronics Corp. Motorola Nissan Philips Pioneer Speakers Samsonite Corporation Samsung Sanyo North America Sony Electronics Tiffany Toshiba VW Xerox Zenith |

Table 1

Even though the Maquila scheme has been heavily criticized because it represents little more than a relocation of the "exploitation" model used in the Far East, it seems the most likely model for the video games industry to follow in Latin America. The creation of a free trade zone from Alaska to Patagonia by 2005--if the political and economic variables remain--will lead to a proliferation of Maquilas all over the continent. Several international corporations that manufacture and sell video games are following the Maquila model and have set up plants that manufacture hardware that could be used to manufacture consoles (Alvarez and Rodriguez 1998)[15] .

Nintendo, for example, has direct investment in Latin America. Nintendo arrived in Brazil in 1993 through Playtronic Industrial Ltda. Between 1993 and 1996 Playtronic launched the Nintendo Entertainment System (NES - 8 Bit), the portable Game Boy, the Super Nintendo Entertainment System (SNES - 16 Bit) and the Virtual Boy (portable l - 32 Bit). In 1996, this company merged with Gradiente Entertainment Ltda, an electronic giant that had been in the market since the 60s. This move coincided with the launch of the first 64-bit video game system, Nintendo 64, which many Latin America analysts considered a "revolution" in the industry. By July 1998 the company had sold 1.5 million hardware units and only 1.4 software units (Nintendo-Brazil Annual Report 2001), which could be interpreted as a sign that the industry was concentrating its effort in hardware. With a manufacturing plant in Manaus and offices in São Paulo, Gradiente Entertainment Ltda operates all over Brazil and is expanding its production to reach other markets in the region, but is focusing mainly on the US. The company is also seeking strategies to take advantage of economic integration agreements such as NAFTA and Mercosur.

Microsoft, with its Xbox, is now competing with Sony and Nintendo in a US$ 6.500 million global market. The company plans to build a hardware plant in Mexico and has not overruled the possibility of licensing the production to independent plants in Brazil and Costa Rica. In six years. Indeed, Microsoft wants to stir up the market in the same way that Sony did (Charles 2001).

Sega, who are withdrawing from hardware manufacturing and concentrating entirely on software, have offices in Puerto Rico and Brazil. In Puerto Rico it operates as Sega since US laws protect it and from there manages its operations for Central America and the Caribbean markets. However in Brazil this same company has an association with Tec Toy, a local firm that has experienced significant growth in recent years and in 1996 sold more than 2 million video games in the Mercosur. Tec Toy is a Brazilian company, founded n 1987, which today ranks second in the Brazilian toys market according to data published by ABRINQ (Association of Toys Manufacturers). Other partnerships were signed with Vtech, Tiger, Nikko and Tyco. Because of Sega's announcement that it was stopping hardware production, the company is launching a new market and production strategy, and Arnold and Dazcal, founders of the company, have not ruled out expanding their products to generic accessories.

It appears that there is a common pattern in which global corporations do not directly manufacture their own products, but rather sub-contract them to local firms and then resell them with their logo stamped. A model used in the past by multinationals such as Nike, Adidas and other clothing manufacturers in the Far East.

New pieces but the Same Old Game

The future of the video games industry in Latin America seems clearly defined by international factors. In our view the logical development of this industry will be towards a rationalisation of the Maquila through joint ventures with local toys and games manufacturers (the model has been well described by Pérez Sáinz 1998). The markets of Mexico and Brazil will probably be primary targets, but it will be the access to the US market that will offer the video games industry the potential to develop as an important centre for production and distribution in the region.

We suggest that a clear analysis of the video games industry in Latin America should be undertaken within a global context. In this sense, some analysts predict that by 2003 the global toys and games industry will be worth almost US$80 billion at1998 constant prices (Euromonitor 2000). Toys and Games: A World Survey (Euromonitor 2000) also predicts that Latin America will take an increasingly bigger portion of this market since both population and income growth rates are increasing[16] .

Another important factor to consider is that the region appears to have the potential to assemble hardware and could eventually develop generic video games hardware. However, it is likely that this will only happen under the Maquila scheme. If, and only if, the industry is able to consolidate under this model, then perhaps it could start developing software. In any case, the transfer of technology and skills will be a key issue, but this will also depend on a number of factors, including national policies, political variables and economic conditions.

We are tempted because of technological determinism to see new things almost everywhere. We have come to refer to video games as a "new cultural industry'" (Hesmondhalgh 2002). But the economic relations of agents of production, distribution and consumption mainly define the nature of an industry, even if the process occurs in a multi-platform environment. In the mid 90s there was an important amount of literature based that carried an optimistic view in which new media technologies were able to liberate the forces of progress and development. Some authors (Drucker1993) went so far as to say that some Latin American countries were in the "take-off" stage of their development[17] thanks to these new technologies. Even though we have left behind many of these preconceptions, they are still very powerful concepts within the academic and business community. For this reason it is even more important to look further back and recall other authors such as the Brazilian economist Celso Furtado (1970) who observed more than three decades ago that:

In Latin America for many years the penetration of modern technology was virtually confined to the infrastructure sector and has shown a pattern in which assimilation of technology is decidedly slow, particularly in the direct productive activities.

The current trend is not remarkably different: the video games industry in Latin America is just another evolving chimera. It is still far from a defined industry, but it possesses many of the characteristics of other cultural industries. Its political economy perpetuates the model of dependence and reproduction at both the economic and ideological level, but, as with other cultural industries, it has the potential to liberate creative forces within the region. Like television, radio and film it also sells ideology through entertainment, but the old analogue technologies also offer the opportunity to develop an indigenous content.

Nevertheless, the degree of added value and local participation in the production process seems even more constrained than in other cultural industries. At the moment there is not even the scale of economy capable of justifying small operations in this sense. It seems improbable that the region would have the opportunity to offer its own version of Space Invaders--as the television did with the telenovelas--because the market and the industry have already been colonized and the economic actors appear to be from another planet.

References

Alvarez, Victor & Rodriguez, Davgla (1998). De la Sociedad Rentista a la Sociedad del Conocimiento. Maracaibo. Fundacite.

Arthur, Charles (23 May 2001). Battle Stations. The Independent (UK),

Baldwin, Thomas F. et al. (1996). Convergence. Integrating Media, Information and Communication. Sage. London.

Cole, Ricgard (1996). Communication in Latin America. Scholarly Resources In. USA.

Cordeiro, Jose Luis (1995) El Desafio Latinoamericano. Caracas. McGraw-Hill Interamericana.

Drucker, Peter F. (1993). Post-Capitalist Society. Oxford. Butterworth-Heinemann.

Euromonitor International (1999) Toys and Games: A World Survey. Global Market Reports.

Furtado, Celso (1970). Economic development of Latin America. Cambridge. Cambridge University Press.

Galperin, Hernan (September 1999). Cultural Industries policy in regional trade agreements: the cases of NAFTA, the European Union and MERCOSUR. Media Culture & Society. No. 5 , Vol. 21: 627-648.

Gómez, Ricardo (2000.). The Hall of Mirrors: The Internet in Latin America. Current History. Vol. 99 No.634, pp.70-78.

Gradiente Relatório Annual (2001).Informações Financeiras.

http://www.gradiente.com/empresa/relatorio/index.asp

Hesmondhalgh, David (2002). Cultural industries. Sage. London.

Myint, H. (1972). South East Asia's Economy: Development Policies in the 1970's. Penguin. New York.

Pérez Sáinz, Juan Pablo (1998) From the finca to the maquila: labor and capitalist development in Central America. Westview Press. Boulder, Colo. (USA).

Price, Simon (May 2001). Captain America. Develop. Issue 7, pages 13 to16.

Scheeres, Julia (Jan. 25, 2001). Latin America: The Mobile World. Wired Magazine.

Sheff, David (1993). Game Over: Nintendo's battle to dominate an industry. London. Coronet Books.

Skirrow, G. (1990). Hellivision - an analysis of video games. The media reader, British Film Institute, London, pages 321 to 338

Stoddard, Ellwyn R. (1987). Maquila: assembly plants in northern Mexico. Texas Western Press, the University of Texas at El Paso (Mexico).

Tironi, Eugenio & Sunkel, Guillermo edited by Gunther, Richard and Mughan, Anthony (2001). Democracy and the Media. Cambridge. Cambridge University Press.

World Times/IDC (January 1 2001). Measuring the Global Impact of

Information Technology and Internet Adoption. The World Paper.

http://www.worldpaper.com/2001/jan01/ISI/2001%20Information%20Society%20Ranking.html

Endnotes

[1] El Universal, 11 January, 2001.

[2] After 20 years it established its first landmark with Atari (Sheff 1993).

[3] The North American Free Trade Agreement is a commercial pact between Canada, Mexico and the US, very similar to the European Economical Area. According to NAFTA the three countries are able to import and export 90 percent of their products without been taxed. The idea is to develop this agreement into a continental agreement that will run from the Patagonia (Argentina) to Alaska (US) by 2005.

[4] Others companies seem very aware of the potential of the Latin American market. America Online Latin America Inc. (AOL) has finalized the terms of a $150-million funding package from its three main stockholders that the company expects will help it to become the leading interactive services provider in the region. America Online Inc., a wholly owned subsidiary of media giant AOL Time Warner Inc., is purchasing $66.3 million in redeemable convertible preferred stock while Venezuela's Cisneros Group of Companies (ODC) is buying another $63.8 million (Reuters 2001). The main objective is to be a key player in the development of the Latin American information super highway in the next few years. Latin American is becoming a fertile arena for high-tech developments. It is estimated (IDC 2001) that one in four Latin Americans will own a cell phone by 2004, and the same analysts think that this will lead to greater mobile Internet access (Scheeres 2001).

[5] Which is what other industrial conglomerates did in the 60s and 70s in South East Asia (Myint, 1972).

[6] As an example, the Video Games & Intelligent Toys survey points out that 48% of Latin America's Cartoon Network (CN.com) visitors have downloaded a video game in the last month (versus 29% who surfed for educational purposes). Toys ranked 4th out of a list of 20 products purchased online by CN.com visitors (average age is 9 years old).

[7] This index measures 55 nations' abilities to participate in the information revolution. Designed by a joint venture between World Times and IDC Information, the index provides data and analysis required for measuring progress toward a digital society, assessing market opportunities and developing policies.

[8] Mexico is the second largest Internet market in Latin America after Brazil (Nielsen NetRatings, Jun 11 2001), where 10.4 million people have home Internet access. Over 87 percent of Mexican Internet users visited a search engine or portal site during April, and 80.6 percent visited the sites of telecom companies or Internet providers.

[9] However this was due to the fact that Japanese costumers prefer consoles instead of PC accessories.

[10] Eight persons attended the Focus Group, which was held in Caracas (Venezuela) on December 19th 2000. They came from different parts of the video-game industry and different nationalities, representing different parts of the industry; they were working with big manufacturers, independent chain distributors for video games hardware and software, and other related areas of the industry. The questions and statements were discussed during a period of two hours, 15 minutes.

[11] In fact, Brazil's video games market is bigger than the markets of Spain, Portugal and Sweden put together (Euromonitor, 2000).

[12] It should also be pointed out that most countries in Latin America have Eximbanks and Industrialisation funds created in the mid 1970s, which offers credits with lower rates for this type of operations.

[13] In fact the Universidad de los Andes in Bogota (Colombia) has developed a project called Ludomàtica in which researchers have developed video game software for educational propose in a programme called 'The Fantastic City'. The software is relatively successful and currently is being considered by at least one multinational company.

[14] In video game accessories in 1998, the US represented 960 million US$ which is five times the markets of Western Europe and Japan together (Euromonitor, 2000).

[15] Even the position assumed lately by Brazil, questioning the viability of NAFTA, expanding the Mercosur and distancing from a rigid monetary convertibility scheme, is seen to converge to a point with the creation of the free trade zone for America. This is even more certain after the collapse of the Argentinean economy last year.

[16] Latin America's toys and game industry should not be underestimated with a net value sales for 1998 reach the 1.8 billion US$ (Eurmonitor, 2000) and it is perhaps one of the better-developed manufacturing industries in the southern continent, but the local toys and games industry not only has capital, market knowledge and infrastructure to support global companies, but it also has the capability to lobby legislators, custom officers and other political agents that affect operations.

[17] In fact Drucker refers to Mexico. Paradoxically this was written just before the Tequila crisis of 1994.

Copyright © 2001 - 2004 Game Studies and each author.