Red Threads: Robert Maxwell and the Early UK and International Videogames Industry

by Alex WadeAbstract

This paper examines Robert Maxwell’s involvement with the UK and global videogames industry. While Robert Maxwell was heavily involved in the formation of the UK and international videogame industry, accounts of his involvement are often limited to the intrigue around the acquisition of Alexey Pajitnov’s seminal puzzler Tetris from the USSR in the late 1980s. Yet, for scholars of videogames, Maxwell’s influence over the videogames industry extends far beyond feted accounts of Russian software, stretching backwards and forwards through the culture and history of the international videogames industry. Contributing to this legacy through archival, primary and secondary sources, this paper unveils Maxwell’s considerable sway over videogames, hardware and software, including histories of Sinclair Computing, Mirrorsoft, Microdealer and Sphere Inc, demonstrating links that extended across Europe and the United States showing the crucial position of Maxwell to the early commercial videogame industry. In conclusion, the paper argues for an unacknowledged and uncomfortable acceptance that local and international videogame industries are built on a pyramid of illegal and unethical activities, at the amateur, semi-professional and professional levels.

Keywords: Robert Maxwell, 1980s British Videogames, Mirror Group, Mirrorsoft, 1980s Eastern European videogames, US videogames

Introduction

Robert Maxwell’s part in the shaping of the contemporary media landscape is broad and deep. With an avowed focus on technology, Maxwell acquired firms from fields as diverse as aviation, football, education and television broadcasting. Nevertheless, Maxwell’s over-riding ambition was to publish. What was published was relatively indiscriminate. Seen in the early successes of Pergamon Press (a publisher of academic journals whose material originated in the Soviet Union) then in the procurement of US/UK book publisher Macmillan (through to the British daily newspaper The Mirror), Maxwell was incessant in his pursuit of fulfilling the self-coined moniker of “The Publisher” (Bower, 1995, p. 17; Thomas and Dillon, 2002, p. 17). With the 1984 purchase of Mirror Group Newspapers (MGN), Maxwell aimed to control the world’s largest media network by 1990 with a turnover of £3-5bn. This agglomeration, which included satellite television, cable distribution networks and newspapers [1] was deliberately -- personally and professionally -- positioned as a genuine contender to Rupert Murdoch’s News International.

The disappearance of Robert Maxwell in 1991 meant that Maxwell died as enigmatically as he lived, with puzzling circumstances surrounding his death off the coast of Tenerife. In his wake, he left a legacy of publications examining his life of which the publisher himself would be proud. Chief among these are two comprehensive biographies by Tom Bower (1988; 1995), and an equally expansive -- and summarily more expensive -- decade long, two volume, Department of Trade and Industry (DTI, 2001) investigation into Maxwell’s misappropriation of MGN’s pension funds, actions which were subject to a criminal trial involving his sons, Ian and Kevin Maxwell in 1995. These studies are united in revealing that Robert Maxwell’s obfuscation of the accounts of the 400 companies under his control were deliberate and executed with pathological precision, such was the degree to which the majority of these companies were losing money. An up-to-date account of Maxwell’s life (Preston, 2021) shows the continuing interest in his life and effect on society far beyond the continent where he was born and made his riches.

Among this firmament of loss-makers was a company which made a profit throughout its short existence, publishing not newspapers, books or journals, but videogames. Mirrorsoft, originally part of MGN prior to incorporation into Maxwell’s domain, partly fulfilled Maxwell’s media agglomeration dream by being the UK’s largest publisher of videogames by 1990 (Hewison, 2005). Without mention in the authoritative histories of record, a highly selective account of Mirrorsoft’s history is recounted in the fascinating international struggle for the worldwide distribution rights to the Russian videogame Tetris (Sheff, 1993; Temple, 2004; Ackerman, 2016).

Even in its short burn of existence between 1983 and 1991, Mirrorsoft and its closely allied companies held sway across the full spectrum of software development, distribution, publication and promotion. With so much activity compressed into such a short period of time, this paper addresses the question of the extent of Maxwell’s and Mirrorsoft’s influence in, around and of the national videogames industry in the UK and internationally. Following establishment of the approach of the paper’s methodological position, the article addresses this question through investigation of five separate, but interlinking areas. First is Maxwell’s hot-and-cold relationship with Clive Sinclair and his role in the wax and wane of the products and companies associated with this, including the underwhelming release of the “next generation” Sinclair QL. Second, through correcting earlier errors in the literature, it identifies the actual founding date for Mirrorsoft, prior to Maxwell’s 1984 takeover and examines the relationships built during this time, including with Hungarian developer Andromeda and software publisher and hardware reseller Novotrade. Third, it locates Mirrorsoft within the wider structure of MGN following Maxwell’s 1984 acquisition, a position even employees were not aware of either at the time, or in retrospect. Fourth, it unveils the peculiar relationship between Microdealer, a videogames distribution company owned by MGN, Maxwell’s 1984 “mercy mission” to Ethiopia during a time of famine and the publication of SoftAid, a compilation of videogames which was intended to raise money for those affected by the ecological catastrophe. Fifth, it reveals the history of Sphere Inc. and Nexa Corp. and tracks their widely reported -- but ultimately unfounded -- part in the transfer of GBP14M from a Maxwell holding company to the US following Maxwell’s death in 1992.

Ultimately, as seen at the conclusion of this article, Mirrorsoft’s loss to the industry in 1991 was a significant blow to the UK videogames industry for two key reasons. First, with many of the UK’s most successful developers such as Bitmap Brothers, Probe and Sensible Software signed to it by 1990, they were placed in immediate financial jeopardy with Mirrorsoft’s dissolution. Second and possibly most importantly, as can be seen with a large company such as Electronic Arts, the requirement for a publisher with global reach when the wider industry was shifting from open platform games development on microcomputers to closed platform games development on games consoles was essential (Anderson and Levene, 2012) and one where, arguably, the UK industry failed to properly respond to. While it is impossible to say what position the UK videogame industry would be in if Mirrorsoft had continued to the present day, its position as a publisher with significant in-house development resources would certainly align it closer with current giant luminaries including EA, Ubisoft and Activision-Blizzard.

Methodology

One of the challenges facing a researcher in the pursuit of Maxwell’s arachnid reach over the UK and international mediascape is the position of his firms as part of other holding companies and their concurrent ownership. Such is the complexity of identifying companies within the wider corporate structure, official reports (e.g., DTI, 2002) do not always provide clarity of position and are therefore simpler and less reflective of the organisation than unofficial biographies (Bower, 1988; 1995; Preston, 2021). In relation to this article, for instance, while Maxwell’s interest in up-to-date technology was widely known, these are often generalised under “multimedia and software publishing” rather than explicitly referred to as “videogames.” As with so many of the bodies orbiting the Maxwell star, identifying the position of individual firms within the corporate structure is akin to navigating from a constantly shifting ship. Even in the historical records of Companies House and the FAME database -- both of which are used extensively as sources of record in this paper -- where a company fits in relation to the public and private companies are partially eclipsed by holding groups and directorships who had little, if any, involvement in the day-to-day, or even strategic running of individual entities.

Given the complexity of the subject matter, where the position, origins and trajectories of Mirrorsoft and allied companies are often concealed, this paper follows the lead of games historians Newman (2012) and Therrien and Picard (2016) in acknowledging that there is a fog which is common to all (media) histories. There will rarely be full precision in the histories of videogames, which is partly due to the tendency of such writing to provide linear, list-based histories based around significant technological shifts, such as the movement between hardware “generations.” In its method of running Maxwell as a red thread which runs backwards and forwards the UK videogames industry, this paper shares characteristics with the “pathological” approach identified by Suominen (2017), in that it represents “deep diggings or deep excavations” (p. 555), which, following Apperley and Parrika (2015) identify recurring discourses and promote alternative histories, central to the emergence of the transnational dynamics of ‘local game histories’ (Wade and Webber, 2016). The increasingly powerful influence of this type of work can be seen in its application to histories of British videogames (Litherland, 2020) and the reflexive position of British and Central and Eastern European hardware and software, practice and praxis in relation to one another (Švelch, 2018). When local game histories are compared and contrasted they reveal fascinating and unsettling commonalities across and between spaces and times, which are fecund for the involvements of rogues like Maxwell.

This is revealed in the “three C’s” of the early videogame industry: coding, copying and cracking. In the UK, “coding” on home machines often duplicated arcade machines with only the copyright message was altered for home releases; the altering of code of games in Germany and central Europe, known as “cracking” inspired a network of similar minded young people to trade games as part of a competitive underground which developed into the demoscene, while the universal piracy which took place throughout Europe where only 10% of games in circulation were original shows the widespread adoption of “copying.” All of this was compounded in central and eastern Europe by the smuggling of hardware and software across intransigent borders between east and west. These actions reveal an unacknowledged and possibly unwanted predicate of videogames: they are constructed on an edifice of illegal and unethical practice, which stretches across local and national boundaries. Therefore, it should not be a surprise that rogue-like Maxwell was involved in the embryonic commercialisation of videogames: in fact, it would be more of a surprise if he wasn’t. Maxwell simply made these practices profitable under the marker of capitalism, whereas before they were mostly the medium of informal networks of information sharing and gift exchange.

The Spectrum Connection

As recounted by Bower, the journey from Robert Maxwell’s birth into absolute poverty in what was then Czechoslovakia in 1923 to being lauded as “The Publisher” (Bower, 1995, p. 17) and in control of 400 companies at the time of death in 1991 suggests a drive beyond success towards one where nothing short of outright triumph and mastery would suffice. From his time as a young person in Carpathia, a geographical region historically in Northern Maramureș, Maxwell was immersed in a variety of dialects, sociolects and idiolects, contributing to his achieved status as a polyglot, a skill he employed successfully as a private to the British Army, a politician to the UK Labour party, a publisher to the establishment and a patron to the Soviet Union. Among his many ardours were food, a desire for publicity and celebrity and family. Other, less well noted loves centred on games and technology. His son, Kevin, acknowledges the educational aspects of financial games of chance and skill bestowed upon him by his father insisting that even when playing the Monopoly board game, a win-at-all costs ethic was the only game in town (Bower, 1995, p. 18), turning Maxwell into a “big brave gambler” who played the markets for GBP 100 million at a time (Bower, 1995, p. 26). This love of alea was tempered by Maxwell’s “unrestrained love of technology” (Bower 1995, p. 53), which was found early on when Maxwell became aware of financial challenges at Sinclair Radionics -- the precursor to Sinclair Computers run by the brilliant, but underfunded, inventor Clive Sinclair.

In 1971, facing bankruptcy, Gordon Southward, chair of the Advanced Instrumentation Modules (AIM) Group, which shared premises and resources with Sinclair Radionics at St Ives in Cambridge, persuaded Robert Maxwell, who had long been seen as an investor in troubled technological enterprises to invest “just a little more” (Dale, 1985, p. 34). Maxwell would only proceed if he was given complete control of the AIM group. Eventually, Clive Sinclair offered the requisite GBP 25000, but the AIM group were placed into receivership and dissolved anyway. Fourteen years later, following the unbounded success of the Sinclair ZX81 and ZX Spectrum microcomputers, the January 1984 release of the Sinclair QL (Quantum Leap) was much anticipated. The combination of a verdant environment for domestic development, embodied in the “bedroom coder” phenomenon, coupled with enthusiastic international demand meant that Sinclair’s position at the top table of microcomputer hardware manufacture alongside Apple and Commodore should have been assured.

However Sinclair, as it had done so often in its history, tasted the salt of defeat where there should have been sweetness of victory. Extending earlier principles of developing bespoke hardware -- such as the Microdrive, seen as a “deliberate Sinclair policy to discourage software houses from writing games” (Dale, 1985, p. 134) -- the QL was deigned by Sinclair to be a “serious” computer where games were seen as a trite waste of time. Ignoring one of the first rules of platform manufacturing of looking after the core customer base first (see e.g., Kent, 2021) the QL was a failure upon its release. By April 1985, manufacturing of the QL had ceased: low demand had led to thousands of the machines being stockpiled and Sinclair sustained a GBP 18m loss.

Maxwell, himself well familiar with uneasy personal relationships and fiscally challenging situations through his self-alloyed position as a white knight for stricken British institutions, was an early advocate for addressing the “British disease” of underperformance and unfulfilled potential through the “I’m Backing Britain” campaign (Bower, 1988, p. 141). Sinclair, like Aston Martin, Manchester United and the Mirror Group were an impressive, if tarnished, emblem of the soft power of the British establishment. With Sinclair on the precipice of bankruptcy in mid-1985, Maxwell, through his industrial rescue firm Hollis, bid for the company on 17 June 1985 [2] and was summarily pictured on the front page of his own newspaper, The Mirror, solipsistically holding the very same newspaper with the headline, “Maxwell Saves Sinclair.” Revealing the red thread that runs through the British mediascape [3], the takeover, which would see Clive Sinclair’s ownership reduced to 8%, spotlights how the perception of unfulfilled potential runs from AIM to ARM as they fail or shift into foreign ownership. If this leading article from a June 1985 issue The Guardian is any reflection, Maxwell had mainlined into the spirit of the time

Mr Maxwell, it is true, has proved himself an adroit operator at the industrial relations end of the printing industry, so why shouldn't he be let loose at the other end of the British disease, the country's manic failure to exploit its own inventions?(The Guardian, 18 June 1985)

For Maxwell, there was no such thing as leaving an invention -- or situation -- unexploited. As prominent in his newspapers as he was in publishing them, the harmonious shoulder-slapping which accompanied the takeover, where platitudes were promulgated as soundbites for The Mirror’s editorial, could not hide the sad contrition of Sinclair. In referring to the earlier mutual but unconsummated connection between Maxwell and the Sinclair-AIM group of companies, Clive Sinclair reflected on the takeover

I have known Bob Maxwell for a long, long time, fifteen years in fact and he is the ideal guy to run a big business, not just an ordinary sort of business. I do not mind a bit. I do not mind not being in control . . . I am awful at managing established businesses (Sinclair, cited in Adamson and Kennedy 1985, p. 212)

As noted above, Maxwell was a zealous exponent of new technologies. It is therefore not coincidental that Sinclair itself had a pipeline of new technology which had potential application across the spectrum of MGN including large scale silicon “megachips,” broadly viewed as the future of computer processing units and pocket-televisions, which would later find some success in the Sony variant “Watchman.”

Before this potential could be realised, Maxwell and Hollis needed to reduce the stockpiles of Sinclair hardware. There were two approaches to this strategy. The first, executed the day following acquisition saw 400 employees dismissed from the Timex factory in Dundee (BBC Nine ‘O’ Clock News, 1985) where Sinclair computers were manufactured. The second proposed, but never realised, strategy was to export Sinclair computers to the USSR and its satellites, namely Bulgaria. Widely seen as fanciful due to rules concerning the export of microprocessor technology to the Eastern Bloc, Sinclair already had test sites for educational use of the ZX Spectrum, which were expected to be replaced by exports of the more powerful and stockpiled QL enabled by Maxwell’s connections to Eastern Bloc nations (Walton, 1985) via Pergamon Press. By this point, Mirrorsoft, MGN’s videogame and software arm, had already published games from Jim Stein’s Andromeda Software catalogue including Spitfire 40, which was as unsurprisingly successful in Britain as it was unsuccessful in West Germany, as well as acquiring limited distribution rights to Tetris. Indeed, Maxwell counted Soviet leader Mikhail Gorbachev as both a political ally and personal friend.

News of the projected export arrangements was the last to be heard about the proposed partnership between Maxwell and Sinclair, before Maxwell and Hollis quietly pulled out of the deal in August 1985. While Hollis cited problems with Sinclair’s accounts, Clive Sinclair’s personal account tends to ring closer to the historical truth found in relation to Maxwell’s relationships with companies under his control (e.g., Bower 1988; 1995): “I think he [Maxwell] did find with Sinclair Research that he’d have a meeting and say ‘Well this is what I said’ and our people would say ‘No that’s not what you said’” (Sinclair, cited in Adamson and Kennedy, 1985, p. 215). This account highlights the seemingly endless itinerant differences in opinion and position between those charged with designing technology and those whose responsibility is to balance the books behind it.

Framing the Mirror

By 1985, MGN’s London-based videogames and software publishing arm, Mirrorsoft, had emerged as a rival to more established publishers such as US Gold in Birmingham and Ocean in Manchester. Both US Gold and Ocean were pioneers in working internationally, with US Gold famed for bringing American developed software to the UK and Europe (Wilkins and Kean, 2015) and Ocean similarly well-known for its ludic interpretation of Hollywood films (Wilkins and Kean, 2013) such as RoboCop and Batman.

Unlike Ocean and US Gold, who have both had extensive oral and illustrative histories written about them, Mirrorsoft’s history is not well known. There are histories from staff and developers, but these form part of a wider narrative around particular software houses such as The Bitmap Brothers (Harris, 2016) and Sensible Software (Penn, 2013). In focussing on Mirrorsoft tangentially, they provide an important overview, but do not fully reveal either the origin of Mirrorsoft as part of MGN before its acquisition by Mirrorsoft, or its subsequent position within the MGN family of companies following Maxwell’s acquisition in 1984. Drawing on data aggregated from primary, secondary and archival sources, this part of the paper addresses these omissions by locating Mirrorsoft in the time and space it occupied before, during and after its incorporation into MGN. For reasons of economy within this article, this is not exhaustive with further research required to address the fuller history of Mirrorsoft.

Recent videogame histories which include Mirrorsoft in their narratives position the publisher as part of MGN. MGN is broadly used as a three-letter abbreviation for the majority of companies under the auspices of the Maxwell empire. The overt reference to MGN serves two purposes. First, The Mirror, being one of the UK’s best-selling newspapers, made the brand easily recognisable during its investment and divestment during the 1980s. Second, following Maxwell’s fall, it provides an instant connection between Maxwell as a person of intrigue and the concurrent influence of his enterprises. In short, MGN is used as a synecdoche for Maxwell and the corporations under his control. This short-circuiting is useful in general understanding but has a tendency to obfuscate the complexity of these relationships and generate errors in recollection and reporting [4].

The most authoritative histories appear in two articles written by former Mirrorsoft employee Richard Hewison for the enthusiast magazine Retro Gamer, who interviews the founder of Mirrorsoft, Jim Mackonochie, and other ex-Mirrorsoft employees. As development manager in 1983 at Mirror Group -- which was then still owned by Reed International -- Mackonochie’s role as development manager focussed on introducing “new technology into the company” (Hewison, 2005, p. 84). Initially, Mirrorsoft’s focus was on the underexplored educational videogame market. Even as early as 1983, they were demonstrating synergy between brands with Mr. Men, a children’s book series which appeared as a cartoon strip in the Daily Mirror, repurposed as an early videogame release for Mirrorsoft.

Another piece of educational software, Caesar the Cat, demonstrates some of the particulars facing the researcher of Mirrorsoft. It is widely understood that Andromeda Software, the Hungarian software and hardware reseller and the focus of much of the attention of Sheff (1993) on which Ackerman’s (2016) history of Tetris is based, were brought into the Mirrorsoft fold on the back of Maxwell’s connections in Eastern Europe. Yet Hewison distinguishes that Andromeda “submitted Caesar the Cat as an almost finished product” (2005, p. 84). While Hewison does not give a date, the original cassette tape shows that Caesar the Cat was released on the Commodore 64 in 1983, prior to Maxwell’s 1984 takeover. Andromeda Software were themselves part of a coterie of Hungarian finance and tech companies which initially traded under the Novotrade Software name and went on to produce second party titles for Sega’s consoles including Ecco the Dolphin and iterations to Konami’s Contra series (Cassamassina et al, 2001, p. 58) before changing its name to Appaloosa Interactive Corporation in 1996 (Goeller, 1997). The significance is considerable, in that without Mirrorsoft’s input, this may not have come to pass. Caesar the Cat was the first game developed under the Novotrade name and over the next 23 years the firm went on to develop or publish over 50 games across a range of videogame platforms. In so doing they had significant sway in the development of software for the Japanese, European and American videogames industry and the subsequent sale of these worldwide, showing the phenomenon of transfer from the local to the regional to the national to international, transnational and global, so that the “where?” becomes as vital as the “how?”, “why?", “what?” and “when?” (Swalwell, 2021, p. 2).

Interestingly, Caesar’s Travels, the sequel to Caesar the Cat published in April 1984 (again prior to the takeover by Maxwell) was not developed by Andromeda, but Chalk Soft, a Lincolnshire-based writer and publisher of educational materials which itself was dissolved in 2012. It is not known if copyright or property rights were transferred to Chalk Soft from Andromeda, or if Mirrorsoft were the original rights holders and therefore could transfer the title between developers. The entanglement between copyright and the developers of is another in the long list of indicators of the grey and murky origins of videogames.

Jim Mackonochie, who oversaw the inaugural releases of Mirrorsoft games, including Caesar the Cat, founded Mirrorsoft while undertaking his quotidian employment as development manager at Mirror Group Newspapers. The arrangement continued as normal under Mackonochie’s direction even for the six months following Maxwell’s takeover in 1984. However, in typically abrasive fashion, Kevin Maxwell, Robert Maxwell’s son and corporate iron fist, called Mackonochie on Boxing Day 1984 and removed Mackonochie as development manager and immediately made him Managing Director of Mirrorsoft, with the instruction to “stop playing at software publishing and do it properly” (Hewison, 2005, p. 84).

In spite of a 1985 interview where Mackonochie was convinced of the growth potential of educational software (Mackonochie, cited Minson, 1985), the takeover altered the focus of the company. Retrospectively, it is clear that the acquisition by Maxwell changed the direction of Mirrorsoft away from educational software and towards entertainment games and business software, with much of this focussed on MGN’s commercial interests and Mackonochie’s own concerns.

Of particular cultural interest is the 1986 release Fleet Street Publisher, a desktop publishing suite, its title loaded with irony given Maxwell’s announcement that the “Mirror would no longer be printed in Fleet Street” (Bower, 1988, p. 398) -- the traditional home of British newspaper publishing -- from August 1985 onwards. The 1980s national sport of curing the “British disease” by breaking the balkanised industrial unions from coal-mining to car-making was largely successful in printing too. MGN retrieved GBP40m from 2100 redundancies as newspaper printing was outsourced to other parts of Maxwell’s corporation, usually in areas of Britain where labour was cheaper and more flexible (Bower, 1988, p. 400); a strategy also employed to great effect by Sinclair whose “products were developed in affluent Cambridge, but manufactured in impoverished regions of Scotland and Wales” (Adamson and Kennedy, 1985, p.12) and continued to this day in the Apple philosophy of “Designed in California, Made in China.” The communication between disparate sites, so difficult with conventional hot plate publishing techniques, was enabled by employing desk-top publishing software which was in use across MGN and subsequently formed the basis of Fleet Street Publisher, which would eventually become Timeworks Publisher in the UK and Publish It! in the US.

In addition to Mackonochie’s background in printing, he found a natural affinity with Maxwell in a previous career in the British armed forces, where both had served; Maxwell during World War II in intelligence and infantry and Mackonochie more recently as a Royal Navy officer. As the popularity of products from Microprose such as Gunship and Kennedy Approach showed, the intersection between home computers and simulations was becoming well established in the 1980s and some of the most technically able software was seen originating in the military flight simulator genre. Mackonochie’s influence, and that which he was most feted for up until his death in 2013, could be seen in the releases of that time, including Spitfire 40, Strike Force Harrier and the less heralded licensed game Biggles [5]. Mackonochie’s links were central to Mirrorsoft’s expansion into the US market, particularly with Spectrum Holobyte who developed the influential F-16 flight simulator Falcon which was published in the UK by Mirrorsoft. The American arm of Mirrorsoft’s operations is discussed in greater detail below.

The Corporate Position of Mirrorsoft in Mirror Group

As noted throughout this paper, there is a general sense of confusion both around the founding of Mirrorsoft, which is broadly seen as a joint venture between Robert Maxwell and Jim Mackonochie, and its subsequent position within MGN. Generally, in the official account from the DTI, software is seen as little more than a footnote to other MGN interests (DTI, 2001, p. 22) and there is no mention of Mirrorsoft in any accounts. The arachnid task of identifying the reach of Robert Maxwell’s group of companies means that only major operating and holding companies are recited in the official DTI and unofficial accounts (Bower, 1988; 1995). Indeed, even those contracted to Mirrorsoft were unaware of the company’s position “I think they genuinely saw themselves as a cross media company,” which was countered by a feeling that gaming itself was anonymous in this convergence “I am sure that [Mirrorsoft] like all other games departments in big conglomerates, especially in the 80s and 90s wouldn’t have been very highly prioritised” (Interview with Jon Hare). This is a feeling which appears to be reflected in the lack of emphasis placed on the influence of games and software in the biographical and business accounts, but is not one which bears up under scrutiny.

This is chiefly because, as the wider financial accounts testify, Robert Maxwell’s companies were shored up by a whorl of horse-trading and share swaps to bracket the falling public value of MGN. Its company profile lodged with Companies House is as a designer and publisher of “entertainment and business softwares in the United Kingdom and abroad.” It was highly successful in this pursuit. As of 1990, the final year of reporting before the collapse of the wider group, Mirrorsoft reported an £806,000 profit on an £8.01 million turnover (FAME database: Mirrorsoft Ltd).

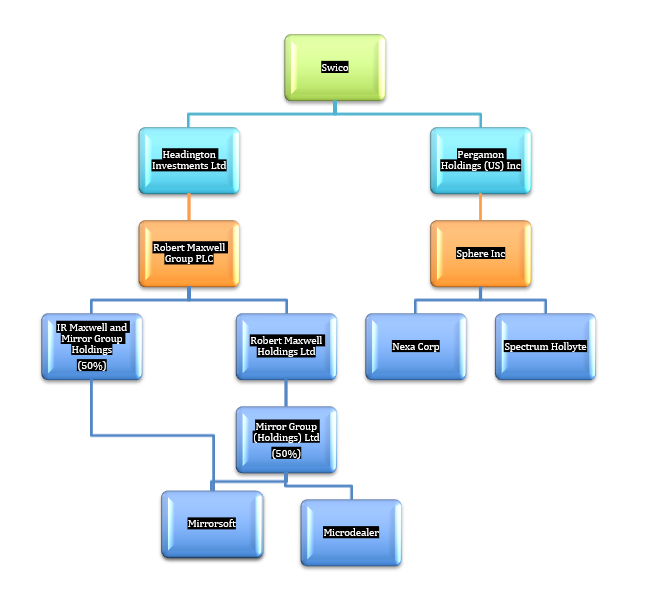

As Figure 1 shows, Mirrorsoft was 50% owned by Mirror Group (Holdings) Limited and 50% owned by IR Maxwell and Mirror Group Holdings Limited. Even though these names were similar, these were separate entities, with the mimicking of titles across the group “not accidental. Maxwell’s intention was to confuse outsiders” (Bower, 1988, p. 538). Robert Maxwell was the ultimate owner of IR Maxwell and Mirror Group Holdings, while the other 50% shareholder, Mirror Group Holdings, has no financial data filed. However, the owner of Mirror Group Holdings is 100% owned by Robert Maxwell Holdings, (RMH) whose documents reveal further software and game interests, including Microdealer, (Mirror Holdings Limited, 1988, p. 19). RMH was part of Robert Maxwell Group PLC, who through Headington Investments were ultimately owned by Swico, a holding company operated in Lichtenstein, owned by Robert Maxwell which directly owned Sphere Inc., an American software house. They are discussed in further detail below.

Figure 1: The position of games and entertainment software in the Robert Maxwell Group of companies. Click image to enlarge.

Microdealer

Although little is known about Microdealer in the oral histories which relate to the time, their financial data places them as a rival to Centresoft in that their principle activities are listed as “the distribution of home computer hardware and software” (ICC Financial Analysis Reports, 2005). Their position within the wider corporate structure was identical to Mirrorsoft, with ownership split equally between IR Maxwell and Mirror Group Holdings Limited and Mirror Group (Holdings) Limited, before RMH assumes full ownership. As with other firms in this field, such as US Gold’s Centresoft, this was a company whose prime aim was to distribute, not publish, software. In spite of this, there are links to American Action, a Swedish publisher of First Star Software’s games, who published Boulder Dash with Mirrorsoft in 1984 and claimed to be the longest established developer of videogames under continuous ownership, until they were bought by Bertelsmann in January 2018.

As a distributor, Microdealer had extensive links between British high street retailers such as WH Smith’s and Boots and developers and publishers, including Quiksilva. One of the most intriguing relationships was Microdealer’s project with Quiksilva. Quiksilva was the publisher of one of the first videogame compilation “best of” tapes, Soft Aid. Soft Aid was unique in that it was an initiative carried out on behalf of the wider videogames’ software industry by Quiksilva’s Rod Cousens to raise funds to mitigate the human and environmental catastrophe wrought by famine and drought in Ethiopia. Microdealer were the key distributor for the title using their extensive networks with high street chain stores to guarantee prominent shelf space and promote the product. An initiative by the UK popular music industry, headed by Bob Geldof, “Band Aid” [6], had earlier been highly successful in raising funds for the same cause and Soft Aid was both endorsed by the singer and included the Band Aid song “Do They Know Its Christmas?” as an audio recording (Sinclair User, 1985, p. 8): the propensity to switch between audio and digital media a key benefit of using cassettes as a magnetic storage medium for games.

The challenges facing Africa were close to Maxwell’s heart. In November 1984, following the spotlighting of the plight of Ethiopia in Michael Buerk’s famous BBC News report, Maxwell flew to Western Africa on a Mirror mercy mission to become the first patron -- including Northern Hemisphere nation states -- to provide aid to Ethiopia, which was duly given prominence in his newspaper (Milner, 2000). Given Maxwell’s own socialist inclinations, the fit with the failing Marxist state was congruent. However, the involvement of Microdealer in the Soft Aid project does not appear as entirely transparent. A year later, in December 1985, The Guardian reported that in November 1985

Following a storm over non-payment of money collected by charity tape distributor Microdealer on behalf of Soft Aid, the company paid over £135,000 to Bob Geldof’s Band Aid trust...(Kelly, 1985)

As with much of the history around Microdealer, there is little in the way of expansion of this story. In spite of this, RMH group accounts for 1986 identify that “the amount donated for charitable and political purposes by the group totalled £129,000. There were no political donations during the period” (Mirror Holdings Limited, 1988, p. 2). Even if the figure is not a precise fit, the total of the charitable donation is analogous to that which Bob Geldof’s trust demanded from Microdealer with financial data reinforcing The Guardian’s supposition that Microdealer withheld charitable funds from the Band Aid Foundation.

Lines of Flight: Sphere Inc

Like Mirrorsoft and Microdealer before it, Sphere Inc is not referred to in the DTI reports or Bower’s unofficial biographies. This appears as a fundamental omission, for while Mirrorsoft and Microdealer were not provided with a profile outside of the specialist videogame press, the same could not be said for Sphere. Sphere was reported throughout the summer of 1992 in UK newspapers as being a company whose direct links to Swico made them a clandestine Maxwell interest and a potential source of recompense for the pensioners of MGN, who had been defrauded in their pensions savings scheme. Indeed, Sphere Inc are regularly referred to in the popular history narrative around Tetris, as they appear to have signed the rights to distribute the game in Japan and America (Sheff, 1993, p. 311). Although this is an important facet of Maxwell’s part in the formation of the industry, Sphere’s influence is wider and deeper, as in the immediate aftershock of MGN’s implosion, Sphere was perceived as the great hope as the sons and daughters of Maxwell perceived Sphere as the “Phoenix, rising up from the ashes to rebuild the Maxwell empire” (Kaufman, cited in Weber, 1992). The company was formative in providing first-hand experience for Christine Maxwell in her setting-up and running of Chilad, an Internet publishing company, in the late 1990s (Cobain, 1999), which eventually became a platform for big data analysis who counted the FBI counter-terrorism database amongst its clients (Nakashima, 2006).

It is widely reported that Sphere was the name of the company when Gilman Louie founded a software firm while he was still a student at San Francisco State University (see e.g., Ackerman, 2016, p. 105; Ruddock, 1992; Weber, 1992),while Hewison credits Louie with setting up “Nexa Org” (2005, p. 85). Under further examination of company and financial data, precise details of the companies involved can be established and their histories revealed. In 1982, Japan’s ASCII Corporation approached Louie to develop a flight simulator, which would eventually become known as F-16 Fighting Falcon and released for Microsoft Japan’s MSX console and the Sega Master System in 1984. The game clearly shows “ASCII Corporation” with the copyright attributed to “Nexa” on the title screen. Nexa Corp’s interest in flight simulations attracted the attention of Mirrorsoft’s Jim Mackonachie (Hewison, 2005, p. 86) and Nexa Corp would continue to develop videogames with an accent on simulation throughout the 1980s, including Ace-of-Aces (1987) and the timely, if controversial, LA Crackdown in 1988.

Prior to this, Nexa Corp were part of a wider strategy by MGN to establish a foothold in the US entertainment software market. By the summer of 1986, the Maxwells, through Kevin as director, had a controlling interest in Nexa Corp. Spectrum Holobyte, founded and run by Phil Adam and generally viewed as Mirrorsoft’s sister firm in the US, were also a developer of military flight simulators and were summarily brought into the Maxwell fold at the same time through Mackonochie’s own interest in this area. At this point, both Louie and Adam owned 10% of their respective companies, leaving 80% under Maxwell control (Hewison, 2005, p. 85). By 1987, Nexa Corp and Spectrum Holobyte were incorporated into a new company known as Sphere Inc, which was 89% owned by Swico, which also wholly owned Pergamon Holdings (US) Incorporated (PHUSI) (see Figure 1). The offices of Sphere Inc were registered in Delaware on the east coast of the US, far from Nexa Corp and Spectrum Holobyte’s headquarters at Challenger Drive, Alameda, California, the address shown on the 1987 US release of Spectrum Holobyte’s most famous game, Falcon and the first to be released under the Sphere Inc brand [7].

The geographical location of these offices is crucial to the history of Mirror Group Newspapers and Sphere Inc’s part in it. United States Securities and Exchange Commission filings for Microprose (who eventually incorporated with Spectrum Holobyte in June 1993) detail that on 5th May 1992, there was a lease agreement between Paragon Alameda Gateway Associates and Sphere Inc (SEC Info, 2018 p. 53). Prefiguring the 1993 merger, Paragon Alameda Gateway Associates were made up of representatives from Microprose, a well-known publisher of military flight simulations including F-19 Stealth Fighter (1990) and Spectrum Holobyte including Gilman Louie. Microprose, like Spectrum Holobyte and Nexa Corp were headquartered in Alameda, California: the geographical commonality lending its name to the partnership. Yet Sphere Inc’s office headquarters -- and not Spectrum Holobyte’s or Nexa Corp’s -- remained in Delaware.

Just over a month later in June 1992, the UK newspaper press, led by The Sunday Times, traced GBP 14M which had been transferred from the Robert Maxwell Group into PHUSI. This alerted the press to the operations of Sphere Inc, which, through Kevin Maxwell, had opened an office in London. With alleged requests for lines of funding from London financiers, underpinned by Spectrum Holobyte’s and Nexa Corp’s critical and commercial success in videogame software development reinforced by their geographical location in Silicon Valley, there was little doubt that Sphere Inc. was modelled by the Maxwell siblings as a great hope for the future of the stricken media empire.

By continuing Sphere Inc operations in Alameda, via its office in Delaware -- no matter how tangentially -- the trail of money suggested that the videogame publisher and its troupe of developers were the source of hidden money and the target for the ire of a confused and justifiably angry group of people who had been swindled out of their retirement funds. The devil remains in the detail as an unnamed Sphere executive states “If he [Kevin Maxwell] was given access to the [London] building it must be the Maxwell Foundation who gave access, not Sphere” (Ruddock, 1992), affirming that Sphere was unfortunately and unintentionally implicated by association and not guilty by collusion.

In response to the UK press investigation, Spectrum Holobyte reacted quickly. There was a first amendment to the lease between Paragon Alameda Gateway Associates and Sphere Inc on 28 July 1992 (SEC Info, 2018, p. 53) before a plan of reorganisation was put in place on 14 September 1992 (SEC Info, 2018, p. 51) between the two parties nullifying any further overlap between the companies. This is congruent with Gilman Louie’s 24 September 1992 interview with the LA Times where he explains that the byzantine array of companies involved in Sphere Inc led to a host of problems for the firms that he was involved with, before he acquired full ownership of Spectrum Holobyte as a separate and distinct entity from the ambitions of Kevin Maxwell and Sphere Inc (Weber, 1992) and the ultimate merger with Microprose in June 1993.

Conclusion

Through a deep excavation of primary, secondary and archival sources around Mirror Group Newspapers, including Mirrorsoft, Robert Maxwell and his extended involvement in these firms, this paper has revealed the red thread which runs through Robert Maxwell’s involvement in the UK and international software industry. From the early involvement with the Sinclair-AIM group of companies, the position of Mirrorsoft in the corporate structure of MGN, the travails of Microdealer and the controversy surrounding Sphere Inc and US software companies, this is shown as being both important to the formation of the industry in the UK, Europe and the US and shines a spotlight some of the more elusive lines of the Maxwell story.

As the tragic and lurid stories surrounding Ghislane Maxwell’s arrest on sex-trafficking charges attest, there is much about the Maxwell fraternity that remains to be uncovered and told. The same applies to the relationship between the Maxwells and the early videogame industry. This includes, but is not limited to: the company’s ambition to distribute games via phone lines in the mid-1980s through a partnership with UK cable network Rediffusion; the early 1990s use of CD-ROMs as educational, encyclopaedic and entertainment tools, including the full digitisation of the Guinness Book of Records; financial and editorial links between magazine publisher EMAP (who published the best-selling Computer and Video Games magazine) and MGN; David and Richard Darling’s publication of The Games Creator with Mirrorsoft in 1984, before they founded UK developer and publisher Codemasters and Maxwell’s role in north American companies which developed early artificial intelligence.

While these examples suggest that there is a considerable legacy to be mapped beyond the cessation of Mirrorsoft, they also show a surety and clarity of vision of years, even decades beyond the current state of the art. This supports the argument that Maxwell’s ambition was to align MGN as a prototypical tech company operating with vertical integration across hardware, software, infrastructure, distribution which would simultaneously disrupt and underpin “traditional” media such as magazine, book and newspaper publishing. This illuminates the importance of alternative histories -- and futures -- to games studies where the local meets the transnational: Mirrorsoft was a publisher backed by a media conglomerate which had reach to the east and to the west in equal measure and was ideally stationed as an enterprise with intricate and extensive sway just as the games industry was going global. For companies signed to Mirrorsoft at the time, it was clear that they were in a

Very dominant position. Bitmap had products signed to them, Probe had loads of stuff, I think Vivid Image, Revolution, Graftgold. Basically, all the best devs were signed to Mirrorsoft when they went down . . . We were very close to going out of business, but fortunately in the creditors meeting a whole bunch of us developers decided to rally together... (Interview with Jon Hare)

While it can be supposed that the UK videogames industry would look very different in the early 2020s if all of the developers had remained under the Mirrorsoft umbrella, in reality Mirrorsoft was prefiguring the dynamics of many new media companies. Often starting off as small interests, perhaps even as cottage industries, as industries expand commercially, they tend to conglomerate around two or three large players: for Internet industries this tends to be Google or Facebook, for operating systems, Windows or iOS and for games, Electronic Arts or Activision-Blizzard, all of which are built upon pyramids of mergers and acquisitions of earlier enterprises. That these tech giants attract the attention of legislators concerned about the unintended consequences of these products, from echo chambers, to misinformation to lootboxes shows how the outcomes of these companies are rooted in their morally and ethically questionable origins.

Therefore, documenting Mirrorsoft’s position in the histories of videogames becomes more urgent, bristling with potential energy. It may well be that the series of acquisitions that so drove Maxwell would have provided him with his dream and may have placed Mirrorsoft as a direct competitor to Vivendi or Take Two. Given Maxwell’s ambition to beat Murdoch at his own game of being “the publisher” this appears a distinct possibility, but instead of being in the waning arena of newspapers, would be realised in the waxing sphere of videogames.

Maxwell’s obsession with technology -- and games -- appears to suggest that success would have been assured, leaving aside his greater obsession as a collector of companies and unfortunate propensity to spend other people’s money. The intricate layers of this future success are the key driver to understand the labyrinths of the past of commercial software which remains buried under old and new media, newspapers and videogames, archives and histories, games and culture -- awaiting discovery and unknown links to intended and unintended outcomes of an industry. This industry increasingly seems to find its origins in illegal, unethical and questionable practice when its local histories are peeled away. From the contested valleys of Czechoslovakian central Europe, to the British disease of the UK, behind the closed markets of the iron curtain of Bulgaria and Hungary and across the wild west of US capitalism, videogames’ dank and dark local histories stand in opposition to its presentation of clean techniques and sophisticated technology. They are revolutionary, but perhaps not in the way that their acolytes would like them to be perceived.

Acknowledgements

Since beginning my academic studies of games in Spring 2002 as an undergraduate at Keele University, the journal of Game Studies has been an endlessly stimulating arena for expanding and extending the debate around games and their academic value. From those early days, it has been one of my personal ambitions to be published in Game Studies. While I am obviously delighted to achieve this, I could not have done so without the excellent support of the Editorial team at Game Studies, especially Maria Gedoz Tieppo who kept me up to date throughout the entire submission and review process, one which was inevitably elongated due to global events. In addition I would like to thank the two reviewers whose comments, questions, criticisms and queries improved this paper -- and my own knowledge of the gargantuan topic of Robert Maxwell -- immeasurably throughout its submission process. The final piece is distinctly improved due to their input. Much of the work of academic reviewers is never evidenced. On this occasion it was never unappreciated. Thank you.

Endnotes

[1] These interests included the US New York Daily News, MTV Europe, the French television broadcaster TF1 and the Rediffusion cable network.

[2] Bower’s account incorrectly cites this date as being 10th June 1985, seven days before The Mirror’s report.

[3] Other headlines published in The Mirror included "Maxwell saves the Mirror," when his takeover of Mirror Group was complete and "Maxwell saves the Commonwealth Games," when the 1986 Edinburgh Commonwealth Games required financial support.

[4] For instance, Ackerman states that Jim Mackonachie co-founded Mirrorsoft with Maxwell in 1982 (2016, p. 103). While Jim Mackonachie was central to the founding of Mirrorsoft, the given date is prior to Maxwell’s 1984 takeover of MGN and prior to Mirrorsoft’s formation in 1983. Wade (2016) gets the date of Mirrorsoft’s formation correct, but similarly attributes its founding to both Maxwell and Mackonachie as part of MGN (119), again, before its acquisition by Maxwell. Meanwhile, Tom Watson an employee of Mirrorsoft, called it the "strange bastard child of Robert Maxwell" (Watson cited in Harris, 2016, p. 31), which while genealogically correct, is factually inaccurate.

[5] Biggles’ stories had appeared previously in Mirror publications including the serialisation of books in the Junior Mirror in the 1950s.

[6] Band Aid was the name given to the group of music artists who performed the famous charity single "Do they Know it’s Christmas?"

[7] There are a host of games, such as ASCII Corp’s Japanese puzzle game Soko-Ban, whose title screen shows Sphere Inc as existing as early as 1984. These are instances where the game was licensed from the original release (e.g., MSX) and re-released for later platforms (e.g., Apple).

References

Ackerman, D. (2016). The Tetris Effect. Oneworld.

Adamson, I. and Kennedy, R. (1985). Sinclair and the Sunrise Technology. Penguin.

Anderson, M. and Levene, R. (2012). Grand Thieves and Tomb Raiders. Aurum Press.

Apperley, T. and Parikka, J. (2015). Platform studies’ epistemic threshold. Games and Culture, 13(4), pp. 349-369. https://doi.org/10.1177%2F1555412015616509

BBC Nine ‘O’ Clock News. (1985 June 17). Timex Redundancies [News Broadcast]. BBC One.

Bower, T. (1988). Maxwell: The Outsider. Aurum Press.

Bower, T. (1995). Maxwell: The Final Verdict. Harper Collins.

Cassamassina M., Fischer B., Kagotoni C., Lundigran J., Preston J., Russo G. and Tittel, J. (2001 July). Got Talent? Next Gen, Issue 73.

Cobain, I. (1999 August 9). The Maxwell girls spinning a massive Web of wealth. The Daily Mail.

DTI. (2001). Mirror Group Newspapers. The Stationary Office Volume One.

DTI. (2001). Mirror Group Newspapers. The Stationary Office Volume Two -- Appendices.

FAME Database. (2018). Mirrorsoft Ltd: Company Profile.

Goeller, K. (1997, January 6). Largest Developer of Entertainment Software Expands into World Wide Web; Novotrade International Changes Name to Appaloosa Interactive. Business Wire. https://indexarticles.com/business/business-wire/largest-developer-of-entertainment-software-expands-into-world-wide-web-novotrade-international-changes-name-to-appaloosa-interactive/

Harris, D. (2016). The Bitmap Brothers Universe. Read Only Memory.

Hewison, R. (2005). Reflections of Mirrorsoft. Retro Gamer, Issue 9, pp. 52-57.

Hewison, R. (2014). From the Archives: Image Works. Retro Gamer, Issue 105, pp. 82-91.

ICC Financial Analysis Reports. (2005). Microdealer International Limited.

Kelly, D. (1985 December 19). The year of mice and men. The Guardian.

Kent, S.L. (2021). The Ultimate History of Videogames Volume 2. Crown.

Litherland, B. (2021). Ludosity, Radical Contextualism, and a New Games History: Pleasure, Truth, and Deception in the Mid-20th-Century London Arcade. Games and Culture, 16(1), pp. 139-159.

Milner, K. (2000 April 6). Flashback 1984: Portrait of a Famine. BBC. http://news.bbc.co.uk/1/hi/world/africa/703958.stm

Minson, J. (1985 August 19). Looking behind the Mirror. Crash.

Mirror Holdings Limited. (1988). Accounts. Companies House.

Nakashima, E. (2006). FBI Shows off Counterterorism Database. Washington Post. https://www.washingtonpost.com/archive/politics/2006/08/30/fbi-shows-off-counterterrorism-database/8bec6026-4ac2-4d6c-bfc3-98b61b01de3f/

Newman, J. (2012). Best Before: Videogames, Supercession and Obsolescence. Routledge.

Penn, G. (2013). Sensible Software 1986 - 1999. Read Only Memory.

Ruddock, A. (1992 June 7). Maxwell sent £14M to secret family firm. The Sunday Times.

SEC Info. (2018). Microprose Inc/DE -- ‘10-K’ for 3/31/97. http://www.secinfo.com/dRqWm.8wVa.htm?Find=spectrum+holobyte#53rdPage

Sinclair User. (1985 April). “Software for Ethiopia.” Sinclair User, Issue 37, p. 8.

Sheff, D. (1993). Game Over: Nintendo’s Battle to Dominate an Industry. Hodder and Stoughton.

Švelch, J. (2018). Gaming the Iron Curtain. MIT Press.

Suominen, J. (2017). How to Present the History of Digital Games: Enthusiast, Emancipatory, Genealogical, and Pathological Approaches. Games and Culture, 12(6), pp. 544-562 https://doi.org/10.1177%2F1555412016653341

Temple, M. (Director). (2004). Tetris: From Russia With Love [Film]. BBC.

The Guardian. (1985 June 18). Where was the City when he needed it? - Publisher Maxwell rescues Sinclair Research.

Therrien, C. and Picard, M. (2016). Enter the Bit Wars: A study of video game marketing and platform crafting in the wake of the TurboGrafx-16 launch. New Media and Society, 18(10), pp. 2323-2339 https://doi.org/10.1177%2F1461444815584333

Thomas G. and Dillon, M. (2002). The Assassination of Robert Maxwell: Israel’s Superspy. Robson Books.

Preston, J. (2021). Fall: The Mystery of Robert Maxwell. Viking.

Swalwell, M. (2021). Introduction: Game History and the Local. In Swalwell M. (Ed.), Game History and the Local (pp. 1-15). Palgrave Macmillan.

Weber, J. (1992, September 24). Entrepreneur's Wild Ride: His Computer Game Firm Emerges From the Maxwell Nightmare. Los Angeles Times. http://articles.latimes.com/1992-09-24/business/fi-1426_1_kevin-maxwell

Wade, A. (2016). Playback: A Genealogy of 1980s British Videogames. Bloomsbury.

Wade, A. and Webber, N. (2016). A Future for Game Histories? Cogent OA Arts and Humanities, 3(1). Accessed October 27, 2021 from https://www.tandfonline.com/doi/pdf/10.1080/23311983.2016.1212635

Walton, P. (1985 July 9). Computer Horizons: A million micros for Russia / Soviet leader to announce education scheme. The Times.

Wilkins, C. and Kean, R.M. (2013). Ocean: The history. Retro Revival Events.

Wilkins, C. and Kean, R.M. (2015). The Story of US Gold: A very American, British software house. Fusion Retro Books.